39+ can you still deduct mortgage interest

Web One of the biggest changes that was made is that a new cap was introduced on the amount of mortgage debt you can have before your interest is no longer fully deductible. Note that if you.

Mortgage Interest Deduction Bankrate

Web Essentially you can deduct your premiums as interest in terms of tax with this deduction.

. Web In the event of a bank failure the FDIC says it has two roles. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1. Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford.

Web To be clear if your mortgage is higher than 1 million or 750000 whichever applies you can still deduct some interest. So lets say that you paid 10000 in mortgage interest. And lets say you also paid.

You must also have a. Web Most homeowners can deduct all of their mortgage interest. Web Essentially you may be able to deduct the interest of up to 100000 of the debt as well as 130th of the points each year assuming its a 30-year mortgage.

Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. The previous limit was 1. Web The deduction can be claimed only for the interest paid on mortgage debt up to 750000 if the loan was taken out after Dec.

Get The Answers You Need Here. But only for interest paid on a. You may be able to deduct 100 of your mortgage interest paid in the previous year.

Web Youre entitled to deduct only the mortgage interest that you personally paid regardless of who received the Form 1098 from the lender. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Web How much you can deduct will depend on when you purchased your home.

If you took out your home loan before. However higher limitations 1 million 500000 if married. The FDIC insures the banks deposits.

Web For mortgages taken out since that date you can only deduct the interest on the first 750000 375000 if you are married filing separately. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. Web This interview will help you determine if youre able to deduct amounts you paid for mortgage interest points mortgage insurance premiums and other mortgage.

Web The maximum amount you can deduct is 750000 for individuals or 375000 for married couples filing separately. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. As the receiver the FDIC sells and collects the assets of.

A 4 Mortgage Rate Use These Mortgage Charts To Easily Compare Monthly Payments Fast

Mortgage Interest Deduction What You Need To Know Mortgage Professional

India Herald 030216 By India Herald Issuu

Mortgage Interest Rate Deduction Definition How It Works Nerdwallet

Mortgage Interest Deduction Who Gets It Wsj

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Analyzing Interest Rates When Is 2 99 More Than 5 Truth Concepts

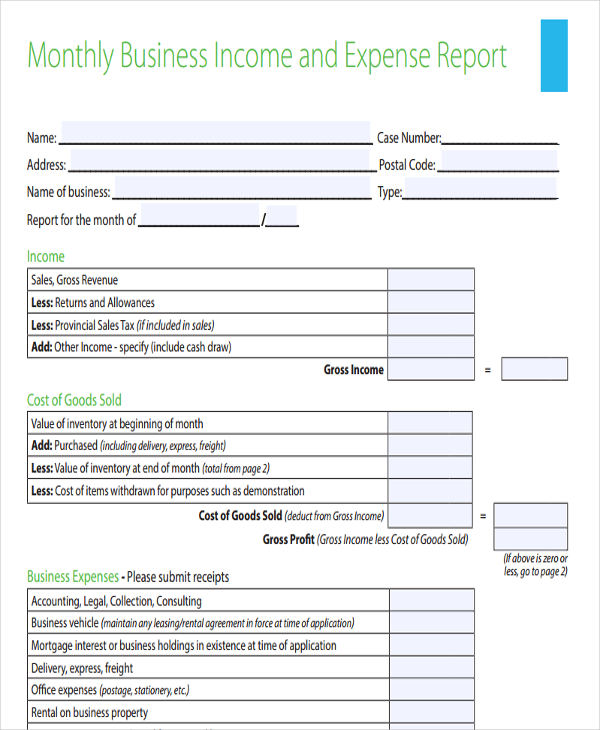

49 Monthly Report Format Templates Word Pdf Google Docs Apple Pages

Mortgage Interest Rate Deduction Definition How It Works Nerdwallet

:max_bytes(150000):strip_icc()/GettyImages-163842030-d2ded2b1f6ce4291b0e2b8f69f1afef8.jpg)

Calculating The Home Mortgage Interest Deduction Hmid

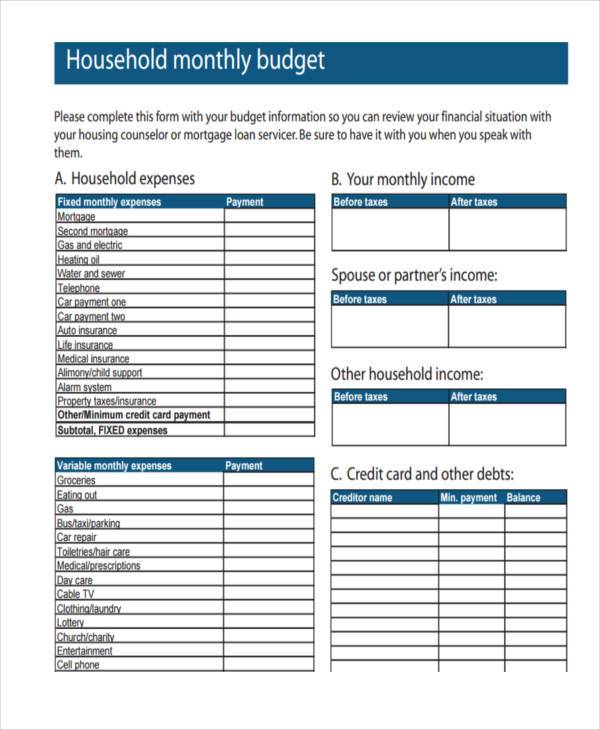

Free 39 Sample Budget Forms In Pdf Excel Ms Word

Goodbye 25 Year Mortgages But Are We Walking Into A Borrowing Trap Mortgages The Guardian

Maximum Mortgage Tax Deduction Benefit Depends On Income

Can I Deduct My Mortgage Interest Even If I Didn T Work During That Year

Calculating The Home Mortgage Interest Deduction Hmid

Royal Suva Yacht Club Fiji Pacific Posse

Mortgage Interest Deduction Rules Limits For 2023